Analyze comprehensive customer data, including demographic information, transaction histories, and engagement patterns, to identify distinct segments based on shared characteristics and preferences.

Employ advanced analytics and pattern recognition to identify and alert on fraudulent activities, reducing financial losses and operational costs associated with fraud investigations and recovery.

Analyze individual customer profiles and financial behaviors to generate personalized loan offers. Drive loan growth by offering custom loan terms and interest rates based on customer preferences.

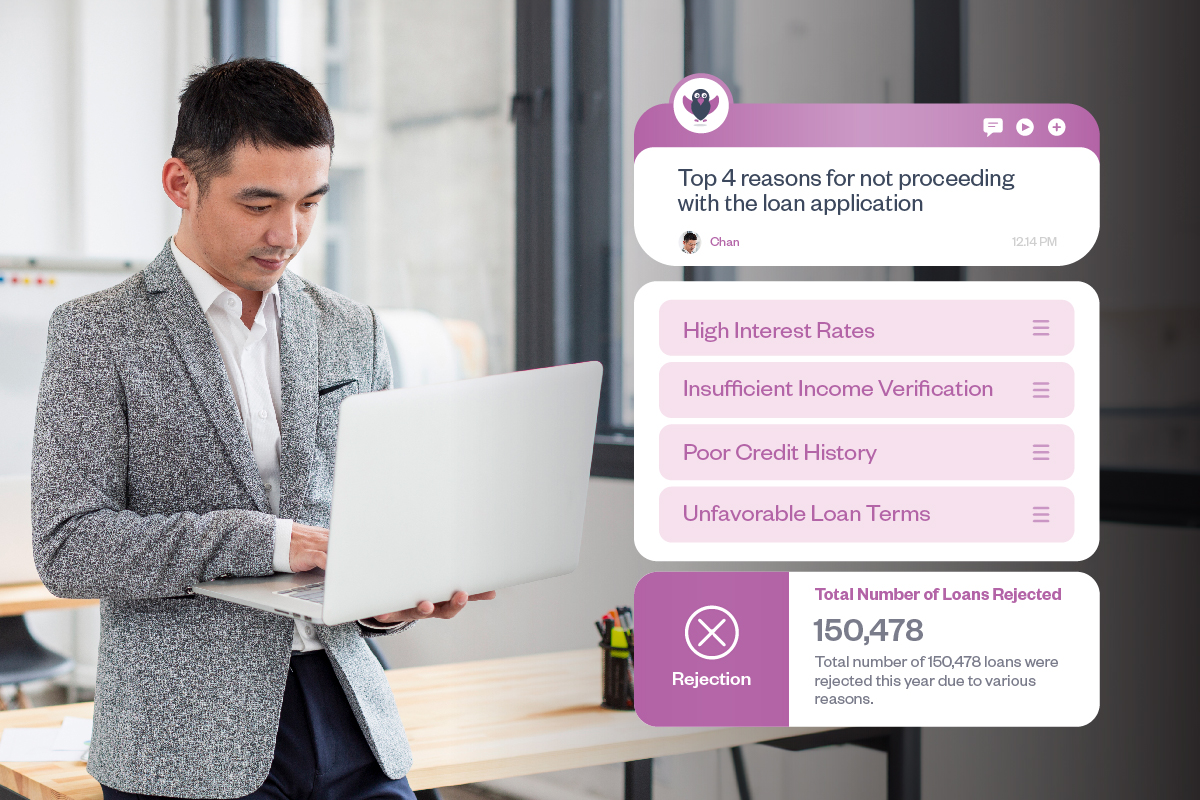

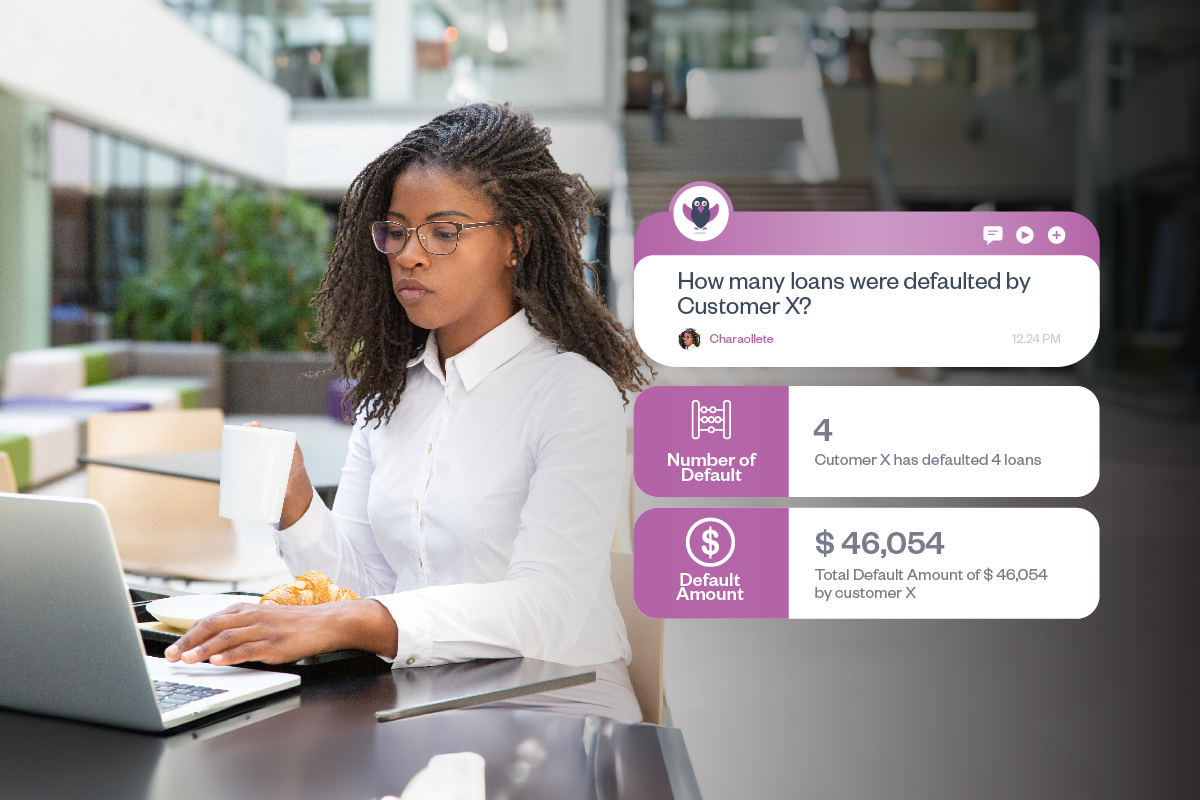

Evaluate customer creditworthiness by analyzing customer data and external financial indicators to better manage credit risks and create a more robust credit risk assessment model.

Analyze member transactions and interactions to identify cross-selling opportunities and enhance the overall product uptake.

Analyze customer needs and market sentiments to create new financial products that satisfy customer requirements and advance their financial goals.